Click here for up-to-date information on Brexit and the post-Brexit future

Britain is seeking to find a way out of its Brexit impasse, with Theresa May’s deal and rival plans battling to secure the support of parliament.

The House of Commons is holding “indicative votes” on Monday on alternative options to Mrs May’s agreement with the EU, and the prime minister is likely to seek MPs’ backing for her plan - for the fourth time - soon after.

Unless the Commons votes for the deal, the UK faces choosing between a long delay, which will involve taking part in European Parliament elections; leaving the bloc without a deal; or revoking Brexit altogether.

The country’s course for future decades could therefore be set in the next few days.

Here the Financial Times provides answers to the big questions about Brexit and what happens next.

What is the latest Brexit news?

MPs will vote on four Brexit options on Monday, in an attempt to find a consensus alternative to Mrs May’s deal ahead of Britain’s scheduled exit from the EU on April 12.

A first round of voting last Wednesday proved inconclusive. Two options — membership of a customs union with the bloc and a second referendum — won significant support, but many MPs abstained or voted tactically.

Supporters of the process hope that MPs will compromise by backing their second or third favoured options, so that one plan can emerge as parliament’s preference.

To win a majority, a proposal needs up to 317 votes. But perhaps the key benchmark is 286 — the number of votes that Mrs May’s withdrawal agreement received when it was defeated in the House of Commons for the third time on Friday.

What will happen next?

Mrs May’s cabinet is gathering on Tuesday to discuss next steps in what may be a brutal discussion. The big focus of attention will be another possible Commons vote on her deal this week, which some see as a last roll of the dice.

If the UK prime minister is not able to get the agreement through, then she could either have to consider leaving the EU without a deal - which many economists and businesses say could be highly disruptive - or ask for a longer extension to the UK’s membership of the bloc.

EU leaders have warned that this would mean that the UK would have to take part in elections to the European Parliament in May - something Mrs May has argued would be barely acceptable almost three years after Britain voted to leave the bloc.

Donald Tusk, the president of the European council of EU member states, has already called an emergency summit on April 10 to discuss Brexit two days before the UK’s scheduled departure date. This could be the moment when the bloc grants a long extension to Britain’s membership, or, alternatively, resigns itself to a no-deal exit.

‣ See our timeline of key Brexit dates

Key

- Completed

- In progress

- Not started

Negotiating phase

NEEDED TO BE WRAPPED UP BY AUTUMN 2018

- Terms of the transition

- Separation terms

- Future status of Northern Ireland

- Framework for future UK-EU relationship

Ratification phase

TO BE COMPLETED BY BREXIT DAY, DATE UNCERTAIN

- Approval by at least 20 of the other 27 EU states at a summit

- UK parliament holds meaningful vote on deal

- UK parliament passes separate legislation to bring exit treaty into British law

- Consent vote by European Parliament

Transition phase

TO END ON DECEMBER 31 2020

- Formal trade talks begin

- UK seeks to replace 750 EU international agreements

- Both sides prepare new immigration/customs/regulatory systems

- European elections in May 2019

Why isn’t the UK leaving on March 29?

The date of March 29 2019 was set for two years as Britain’s scheduled exit for the EU.

But at a summit in Brussels, Mrs May asked for an extension - primarily because of her failure to win House of Commons backing for the exit deal negotiated with the EU.

The prime minister has been seeking to get MPs behind the deal since November - but has failed to win the necessary support from all her own Conservative MPs or Northern Ireland’s DUP. She also needs to make inroads with Brexit-inclined Labour MPs.

Without the Commons’ support for the agreement - which is required by UK law - Britain cannot leave the EU with a deal.

But a no-deal exit implies significant disruption compared with Mrs May’s agreement, since one of the main features of the withdrawal treaty is a transition that would maintain much of the status quo until the end of 2020 at least.

What is the impact on travellers of the delay?

A no-deal exit on April 12 could mean that ports and airports would have to work out new procedures for border and baggage checks at the height of the Easter rush. Meanwhile, travellers would be scrambling to sort out paperwork.

Large numbers of people have neglected to renew passports that would be invalid for travel unless they had at least six months to run before expiry. A discrepancy between the rules in the UK and in the EU’s Schengen free-travel area means that even some passports with more than a year to run would also be invalid. Medical insurance would also be essential, since UK travellers to the EU would no longer be eligible for free healthcare.

Any UK nationals planning to drive to the EU, or hire a car on arrival, would need an international driving permit and a green card for their vehicle insurance. And those who usually take their dog or cat on holiday would need to find space in a kennel or cattery instead – unless they had had the foresight to visit a vet four months earlier for the health checks and vaccinations that would now be required.

How is business responding?

Britain needs a whole new plan if politicians are to avoid a chaotic departure from the EU, according to the director-general of the UK’s largest business association, the CBI. Carolyn Fairbairn said businesses were looking at the parliamentary infighting around Brexit with “a sense of absolute horror”.

According to a survey by the Institute of Directors, another business group, six out of 10 business leaders want MPs to back a Brexit deal that would see the UK closely aligned to the EU’s single market in goods and services.

The delay in the Brexit date has already greatly inconvenienced many companies. Carmakers built their contingency plans around March 29, from booking warehouses and stockpiling parts to scheduling production holidays. They will struggle to adapt those plans to a short three-month delay, or worse still a series of short extensions. Money will be wasted and plans will be torn up.

Will Hassan, the head of European corporate FX at Barclays, also recently said that hedging currency risks was particularly tricky because of uncertainty over tariffs.

What are the preparations for no-deal?

The UK government set out long-awaited trade plans for a no-deal Brexit after Mrs May’s agreement suffered its second Commons defeat in March. The plans, which would apply both to imports from the EU and from outside the bloc, would eliminate 87 per cent of tariffs but introduce 10 per cent duties on cars, and levies on beef, chicken and pork as well as protections for the ceramics industry. But there would be no duties or customs checks on the island of Ireland, since the UK has promised to avoid a hard Irish border.

Most of the UK private sector’s preparation for no-deal has been done by large corporations, especially in the financial, pharmaceutical, automotive and food sectors. Financial services companies have moved assets worth almost £800bn including staff, operations and customer funds to mainland Europe since the 2016 vote, according to the consultancy EY.

One of the greatest concerns is the supply of medical goods. Leading figures in the pharmaceutical industry say huge efforts are being made to ensure patients receive drugs sourced in Europe.

The big drugmakers have already built stockpiles, with most going beyond the six-week supply mandated by government. Ministers have promised to charter aircraft if needed to bring in drugs with a short shelf-life; and medical supplies will take priority on government-chartered ferries. Hospitals and GP surgeries have strict instructions not to create pressures by ordering extra supplies.

The big issue is how consumers will react to the uncertainty. Buying a few extra tins of tomatoes and bags of frozen peas over a period of weeks would hardly matter. But a sudden bout of indiscriminate panic-buying could drive up the price of staples that would otherwise have been available as usual.

Read more about Britain’s year of living dangerously

Read more on stockpiling and the hamster list

What is the impact on EU nationals in the UK?

The UK government is offering the more than 3m EU citizens currently resident in the UK “settled status”, which would grant them the right to stay, even if there is no deal with the bloc.

But a parliamentary committee has said the draft legislation setting out the UK’s post-Brexit immigration regime raises “significant human rights concerns” and should be amended to strengthen protections for EU citizens resident in the country.

A report by the joint human rights committee of the Houses of Commons and Lords pointed out that those accepted under the scheme would receive no physical proof of their status, which might make it harder for them to prove their right to reside in the UK.

The committee warned that EU citizens who do not realise that they need to register risk becoming caught in a legal limbo and could suffer abuses similar to those affecting the “Windrush Generation” of Commonwealth migrants.

What was May’s original deal?

The 585-page withdrawal treaty governs the terms of Britain’s divorce from the bloc, fixing the country’s Brexit bill of £39bn or more, establishing the rights of EU and UK citizens in each other’s jurisdictions and setting up a transition period that would retain much of the status quo and last until December 31 2020, with a possible extension until December 31 2022.

The most contentious provision is the backstop, which would come into effect at the end of the transition period if no other solution was found to prevent a hard border on the island of Ireland.

This would keep Northern Ireland in the bloc’s single market for goods — and so retain much of the EU’s authority over the province — while including the whole of the UK in a customs union with the bloc.

The treaty has twice been comprehensively rejected by MPs, after being put to the vote in a package with a non-binding political declaration that seeks to lay out the options for longer-term ties.

What are the alternatives to May’s deal?

The options range from a no-deal Brexit to a second referendum that could result in the UK staying in the bloc.

Many Brexiters prefer leaving the EU without a deal, because the treaty Mrs May negotiated could keep the UK close to the bloc. Supporters of a softer break favour remaining in the EU’s customs union, the bloc’s single market, or both. And many Remainers dream of a second referendum that could reverse the 2016 decision to leave the bloc.

But in so-called “indicative votes” in the Commons in late March, MPs voted down all eight alternative plans put before them, signalling again that there is no clear path forward on Brexit.

Will Brexit hit house prices?

As the UK’s planned exit from the EU looms, London’s housing market has largely frozen and other parts of the UK have begun to feel the chill.

Overall, year-on-year house price growth across the UK in January was at its slowest in almost six years, with a rise of just 0.1 per cent, according to the Nationwide index; it remained sluggish in February, with a 0.4 per cent increase.

The Royal Institution of Chartered Surveyors said its members’ three-month expectations were flat or negative across the country. It put the sluggish readings down to “ongoing uncertainty about the path to Brexit dominating the news agenda”.

But some analysts argue that a “Brexit bounce” could take place, above all in London, if the UK reaches a satisfactory deal with the EU.

‣ More on how Brexit could affect house prices and mortgages

Will Brexit cause a recession?

Next to no economists forecast a British recession this year — even if there is no-deal. That said, the economy was showing clear signs of slowing down at the end of last year. The hot money that the country’s economy depends on to keep moving is also getting harder to come by.

The lack of clarity over what shape Brexit may take has also made it impossible to produce a single growth forecast for the UK’s economy, according to an increasing number of economists who are publishing multiple predictions based on different outcomes

‣ UK economy since the Brexit vote, in six charts

How will Brexit affect the pound?

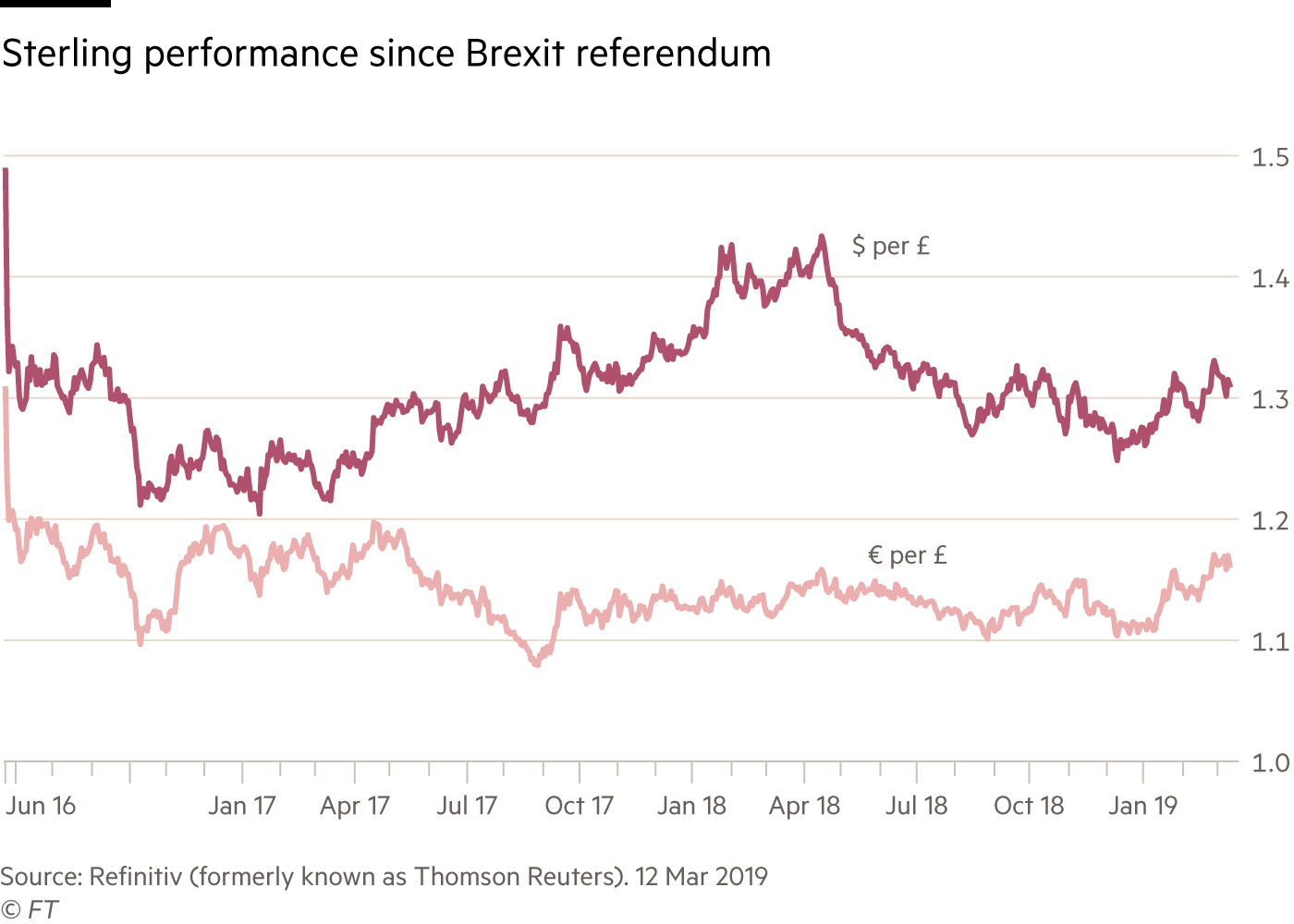

The aftermath of the 2016 referendum has led to some of the most volatile trading in the pound in the past half-century and is expected to continue to do so up to and beyond March 29.

The most widely watched metric of sterling’s performance is its behaviour against the dollar. However, its movements against the euro, which have also been highly volatile, are widely seen as a proxy for Brexit risk.

Read more about Brexit and the pound

‣ A historic look at sterling since 1971

‣ FT Markets Data: Compare GBP with other currencies

What are the customs union and the single market?

In 1968, just over a decade after the European Economic Community was founded, the European customs union was completed, with a common external tariff and the intent of establishing free trade within the area.

Almost 50 years later, the internal market — or single market, as it came to be known — remains a work in progress. The “four freedoms” — movement of goods, services, capital and labour — are a founding principle of the EU.

At stake in the Brexit negotiations are the kind of ties the UK will have with both the single market and the customs union, which could shape Britain’s future for decades.

‣ More on why the customs union and single market are vital to Brexit talks

When was the Brexit vote?

Britain’s historic referendum was held on June 23 2016. Initially the British government had wanted the question: “Should the UK remain a member of the EU?” But the country’s Electoral Commission, which by law has to be consulted, was unhappy with the phrasing, noting concerns that the question was biased and might encourage people to vote Yes.

It recommended in September 2015 that the question be amended to: “Should the UK remain a member of the EU or leave the EU”? The government and parliament accepted these changes and this was the question that was asked.

How many people voted for Brexit?

On a record turnout of 72.2 per cent, 17.4m people (51.9 per cent of voters) voted Leave, while 16.1m people (48.1 per cent) voted Remain in the referendum. The winning margin was therefore 1.3m votes.

‣ Map of the full EU referendum results

[a]Note: this timestamp is used to calculate the countdown clock on the page. It needs to be in exactly this format. The deadline should be as it is in Brussels time, not London. The page will calculate the difference, taking into account time zones, summer time, etc.