On a sunny midsummer weekend in Los Angeles, Netflix turned the Santa Monica Pier — one of the city’s busiest tourist destinations — into a three-dimensional marketing blitz, transforming it into the fictional 1980s Indiana town where its hit show Stranger Things is set. The 110-year-old structures were dressed up to mimic the show’s location; the Ferris wheel was flashing eerie red lights over the Pacific Ocean. The night before, there had been a full marching band for a lavish premiere party.

The marketing push illustrated how critical the show is to the subscription-reliant digital streaming service. The July 4 arrival of the third series of Stranger Things was the “biggest content drop” of 2019 for Netflix, says Bernstein analyst Todd Juenger. “If any one piece of content would make a difference on [subscriber additions], that should be the one,” he adds.

He was right. Global subscriber numbers spiked in the first two weeks of July. Unfortunately for Netflix it was two weeks too late.

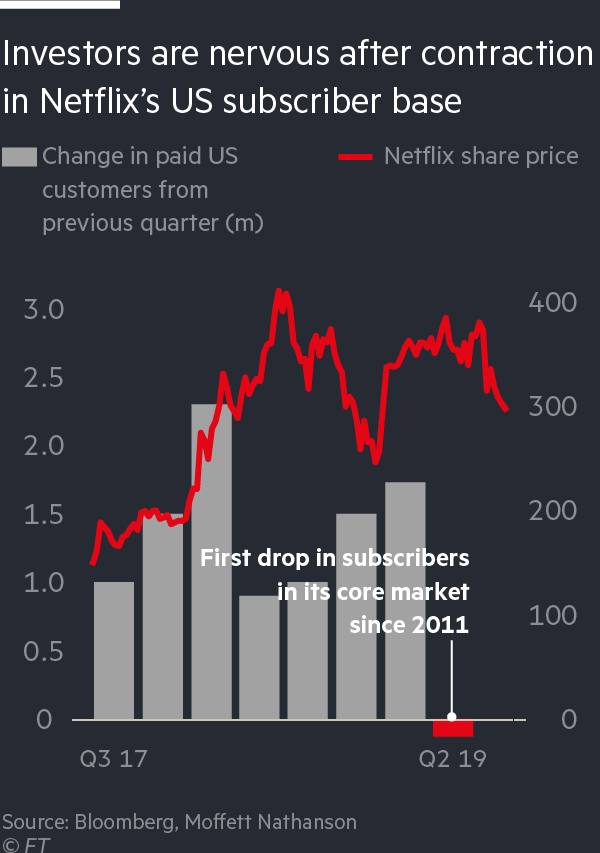

In the quarter to the end of June the company lost subscribers in the US — 126,000 of them — for the first time since 2011. Equally worrying, outside the US the company signed up only 2.8m subscribers — about half of what Netflix had predicted. The market wiped $17bn off Netflix’s stock value overnight, emphasising the brutal correlation between new subscribers and stock market value.

The company is predicting 7m new subscribers in the third quarter. But the dramatic fall in the second quarter — even before the arrival of greater competition from Apple and others later this year — has cast doubt over whether the company, that successfully took on the Hollywood hierarchy is as invincible as it previously seemed.

“The next best thing to success in Hollywood is schadenfreude,” says a senior executive at an independent film studio who has worked with Netflix on TV projects. “There is no better sport. It might even eclipse your own success.”

Wall Street is now seeking evidence as to whether this miss was a blip or a trend. The stock market has become “addicted” to Netflix’s subscriber growth, says Aswath Damodaran, a finance professor at New York university's Stern School of Business who closely follows the company.

“For a decade, [Netflix has] spent more and more money on content to get users and increase market capitalisation, and it worked,” he says. “But the question is: how do you get off this treadmill? At some point spending 75 per cent of every dollar on content won’t be sustainable. The next year is going to be the big challenge.”

***

Netflix spearheaded a streaming revolution that changed the way we watch TV and films. As cable TV lost subscribers, Netflix gained them, putting it in a category with Facebook, Amazon and Google as one of the adored US tech stocks that led a historic bull market.

The company spends more than 70 per cent of revenues on content. Analysts estimate that would give it a budget of more than $15bn this year — more than any other media company. Yet Netflix projects it will spend $3.5bn more than it will generate in cash in 2019, while promising that this mismatch will narrow over time.

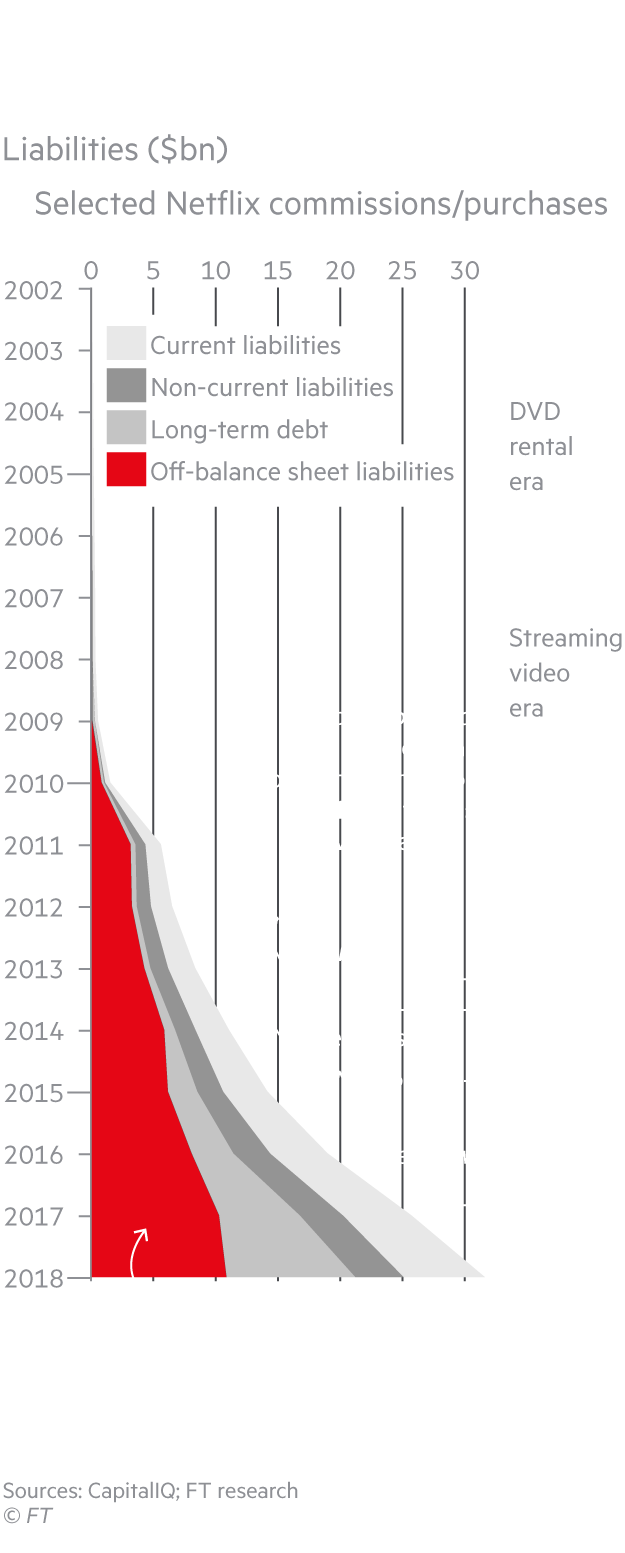

This rate of cash burn means the company has to repeatedly tap debt markets to pay for its content and make other debt repayments. It relies on the faith of investors to fuel the machine, studiously raising more junk-rated debt roughly every six months to help finance its splurge on content.

Netflix has taken on the vast majority of its $12bn in long-term debt in the past three years as it almost doubled its global subscriber base to 150m. In an environment of historic low interest rates, investors searching for yield have happily gobbled up Netflix bonds.

Many of the big legacy media companies initially surrendered their catalogues to Netflix in return for royalty payments. But the streaming service, anticipating that its rivals would fight back, began building its own catalogue before these shows disappeared from its platform.

“People wondered why they were paying so much, but in hindsight it now looks smart,” says a senior film and television banker. “They were building a following [ahead of] an arms race.”

Today Netflix faces an onslaught of competition in the market it invented. After years of false starts, Apple is planning to launch a streaming service in November, as is Disney — with AT&T’s WarnerMedia and Comcast’s NBCUniversal to follow early next year. Apart from Apple, they all have extensive back catalogues. After raising prices in the US earlier this year, a standard Netflix subscription now costs $13 a month. Apple will charge $5 a month and Disney $7 a month for their subscription services.

Traditionally Netflix’s strategy has been to outspend rivals, but it may have met its match in Apple, the second-richest company in the world. Two years ago Netflix got into a bidding war with the iPhone maker for The Morning Show, a comedy-drama television series with a star-studded cast led by Jennifer Aniston and Reese Witherspoon.

“The deal kept going back and forth between Netflix and Apple,” says one person involved in the talks. Ultimately the producers decided to sell it to Apple for more than $300m, in part because they felt the iPhone maker would give it a bigger marketing push.

“On Netflix it would be one of their many great shows. But on Apple it would be the first big marquee show on its new service,” says the person.

Despite this, several former Netflix employees say there is little concern internally about the looming competition. “There was never any fear that we’re in trouble,” says one former marketing executive, who left the company in the spring. “Every quarter felt like a year in which Disney and Fox weren’t in the game. The feeling was that we are leap years ahead. And it’s kind of true.”

***

Netflix first invaded US living rooms with its video streaming in 2007. But it would take another six years before it made a big splash with its own shows. The company paid $100m for two seasons of the political thriller House of Cards, which debuted in 2013 to widespread acclaim, putting Netflix on the map with both audiences and Hollywood.

House of Cards was instructive for how Netflix would approach deals for years to come. The strategy was to spend big to outbid rivals, usually committing to full global rights for series without asking for a pilot. The deal “changed the whole landscape for how TV was created”, says one veteran Hollywood banker. “For the next year, Netflix was gobbling up everything . . .[it became] ‘the only game in town’.”

On occasions the streaming service offered between 30 and 50 per cent higher prices than competitors such as HBO, Showtime and Starz, according to people familiar with these deals. The structure of them also stood out. While traditional networks typically paid on delivery of the show, Netflix sometimes stretched payments out over time, which was accepted because it was paying such a premium, according to people familiar with the deals.

This turned out to be an effective liquidity strategy because Netflix’s debt and liabilities are spread out over years, and much of it is not on the balance sheet but rather listed as “contractual obligations”. In addition to its $10.4bn in long-term debt, at the end of last year Netflix also owed another $19bn in obligations and an additional $2bn to $5bn in “unknown” spending — money committed over the next five years to pay for new shows, and to license the rights to existing TV and movies over multi-year contracts.

In the meantime rival streaming services such as Hulu, Amazon and Apple have become more aggressive in acquiring content, giving producers options beyond Netflix. And bankers are beginning to question whether Netflix will need to change its funding model to continue winning projects because Apple, Amazon and Hulu pay on delivery.

A Netflix spokesman, responding after publication, said the service was already competitive on payment terms, and already paid for some projects on delivery.

The streaming wars have spawned a phenomenon known as “Peak TV”, with bankers saying there has not been as much capital in Hollywood since the mid-2000s, when private equity firms were jumping to finance feature films.

But some observers believe this is not sustainable. “Five years from now, there will not be as many TV series being made, I promise you,” says Jonathan Taplin, an Oscar-nominated film producer. “We have [doubled the number of series] from seven years ago, and we haven’t grown the audience at all. Any idiot in Economics 101 can tell you that’s not a good proposition,” he says, adding that there is “no real precedent for this . . . it’s kind of weirdly new”.

How much do you think Netflix is worth?

Drag to make your estimates, = current data

Drag to make your estimates, = current dataThis is a tool used to estimate the current value of an investment based on projected future cash flows. The calculation uses global subscriber numbers and the current monthly US subscription price. It assumes that Netflix will be paying around 25 per cent tax every year on its earnings. It also assumes its tech development costs will grow at 5% and content cost will grow at 2%. The calculator is based on a discounted cash flow model built by Professor Aswath Damodaran. *This projection is by Professor Aswath Damodaran as of July, 2019

Most of that growth in TV series has come from the streaming services, predominantly Netflix. Some of Hollywood’s most talented executives and creatives have in recent years been lured by the company from other studios, with the promise of eye-popping pay cheques.

But at the start of this year, whispers spread of budget cuts. Marketing spending was trimmed to make more space for Netflix’s content budget. “You would hear it a lot in conversations and in meetings. Money needed to be shifted into tent pole [or blockbuster] films,” says one former executive who left this summer. Netflix has also sliced its budget for direct digital advertising of films.

Netflix declined to comment, but someone close to it says the company is experimenting with its promotional strategy and plans are likely to change with the imminent arrival of a new chief marketing officer, Jackie Lee-Joe, who joined from BBC Studios.

When it comes to content, however, there is little evidence that Netflix is tightening its purse strings. The week before the announcement that it had lost subscribers in the US, Netflix agreed to spend about $200m to make Red Notice, a Dwayne Johnson action film. A few weeks later, it signed a $200m deal with the Game of Thrones creators for future productions.

***

Netflix thrived during a period of easy money and a stock market rally. But recessionary fears have roiled markets recently, and critics believe that a credit crunch would dent its debt-driven model. The company admitted as much in its annual statement, warning that “our streaming obligations include large multiyear commitments”, and that “as a result, we may be unable to react to any downturn in the economy . . . by reducing our obligations in the near term”.

However, analysts and investors still believe firmly in the Netflix model. More than 80 per cent of stock analysts rate the company as a buy. Even after the loss of subscribers in the second quarter, Ben Swinburne, head of media research at Morgan Stanley, says Netflix is still on course for a record year of subscriber additions.

Analysts, on average, project that cash flow will break even in 2023 as subscribers and margins improve. “They’re balancing growth versus investment and we understand that. It’s quite expensive to create so much content,” says S&P analyst Jawad Hussain. However, he warns: “In 2020, if we don’t see a material improvement in cash flow deficit, that would be a worrying sign.”

Mr Hussain expects Netflix to issue at least $3bn in debt next year to comfortably cover its costs.

It does have levers that it can pull. More than 70 per cent of its long-term debt is not due for at least five years, which in theory would give it time to adjust its spending if there were to be a downturn. However, a pullback on content also runs the risk of losing subscribers — Netflix blamed its second quarter numbers on a weak content slate.

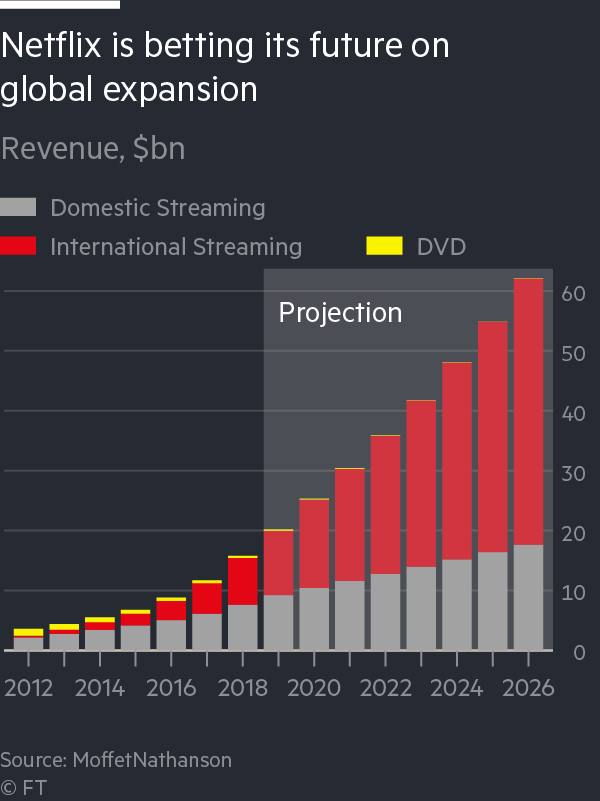

Optimists point to the group’s global reach. It is betting its future on an expansion outside the US, where it has already attracted 60m subscribers. The company is investing heavily in content in places like India and Malaysia, with a focus on local-language programming.

However, the economic prospects in these territories are weaker. Netflix subscriptions in India start at the equivalent of $3 a month, compared with its cheapest plan in the US which is three times that, resulting in thinner margins compared with its US business.

Netflix most recently raised debt in April to a rapturous reception, selling $2.2bn in 10-year notes in an auction that was three times oversubscribed. Based on its previous schedules, it would next be expected to tap investors in October.

For now the stock market appears to be siding with the critics. Netflix’s shares have sunk further since its July slide, touching an eight-month low that values the company at $127bn.

“They have to reframe the story,” says NYU’s Mr Damodaran. “If they have a couple more bad quarters, the market will tell the story for them.”

Additional design by Jane Pong