Negotiating the Strait of Hormuz requires mastery not just of nautical charts but also of the complex and muddy international law governing right of passage through the shipping lane. The strait is regulated by the UN Convention on the Law of the Sea of 1982. Iran has signed but not ratified the convention; the US has not signed it. Tehran argues that only states party to the convention ‘shall be entitled to benefit from the contractual rights created’, including the right of passage.

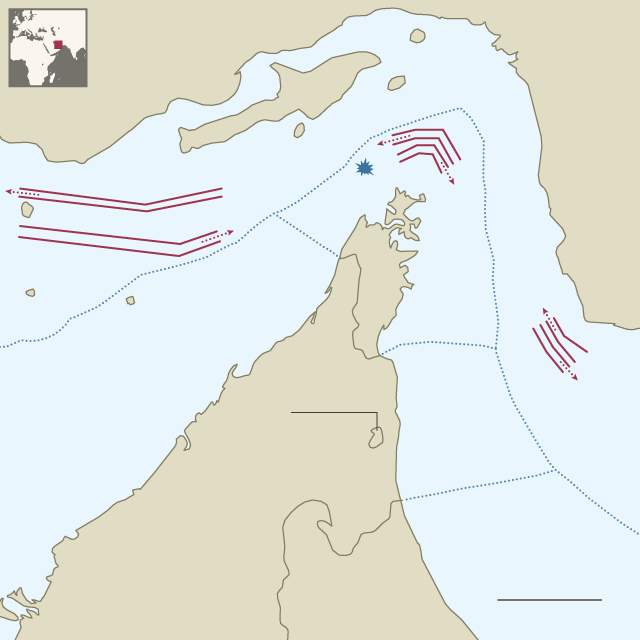

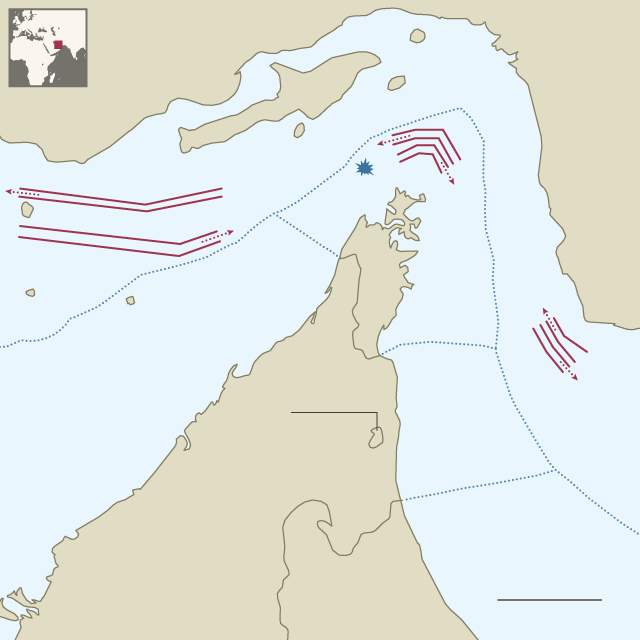

Location of M Star tanker explosion

1

Strait of

Hormuz

IRAN

Shipping

lane

2

Western

separation

scheme

Omani

territorial

waters

Iranian

territorial

waters

OMAN

UAE

territorial

waters

Maritime

boundary

3

Separation

scheme

UAE

territorial

waters

OMAN

UNITED

ARAB

EMIRATES

Fujairah

Iranian

territorial

waters

Omani

territorial

waters

4

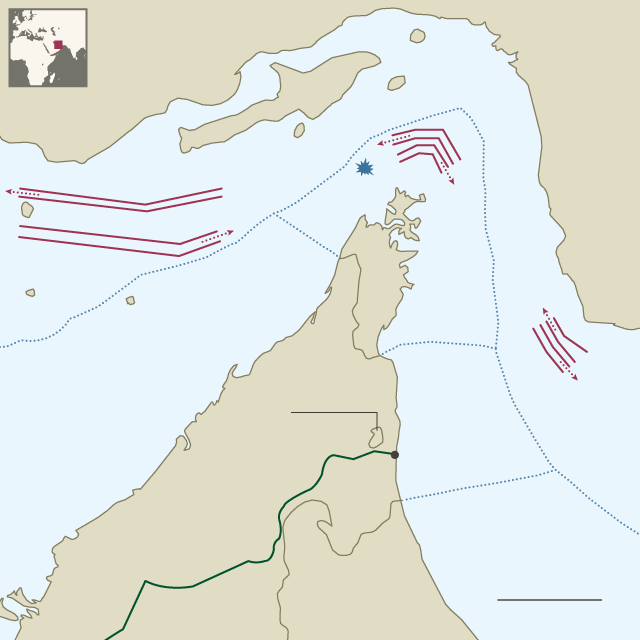

Habshan-Fujairah

pipeline

50 km

OMAN

27 nautical miles

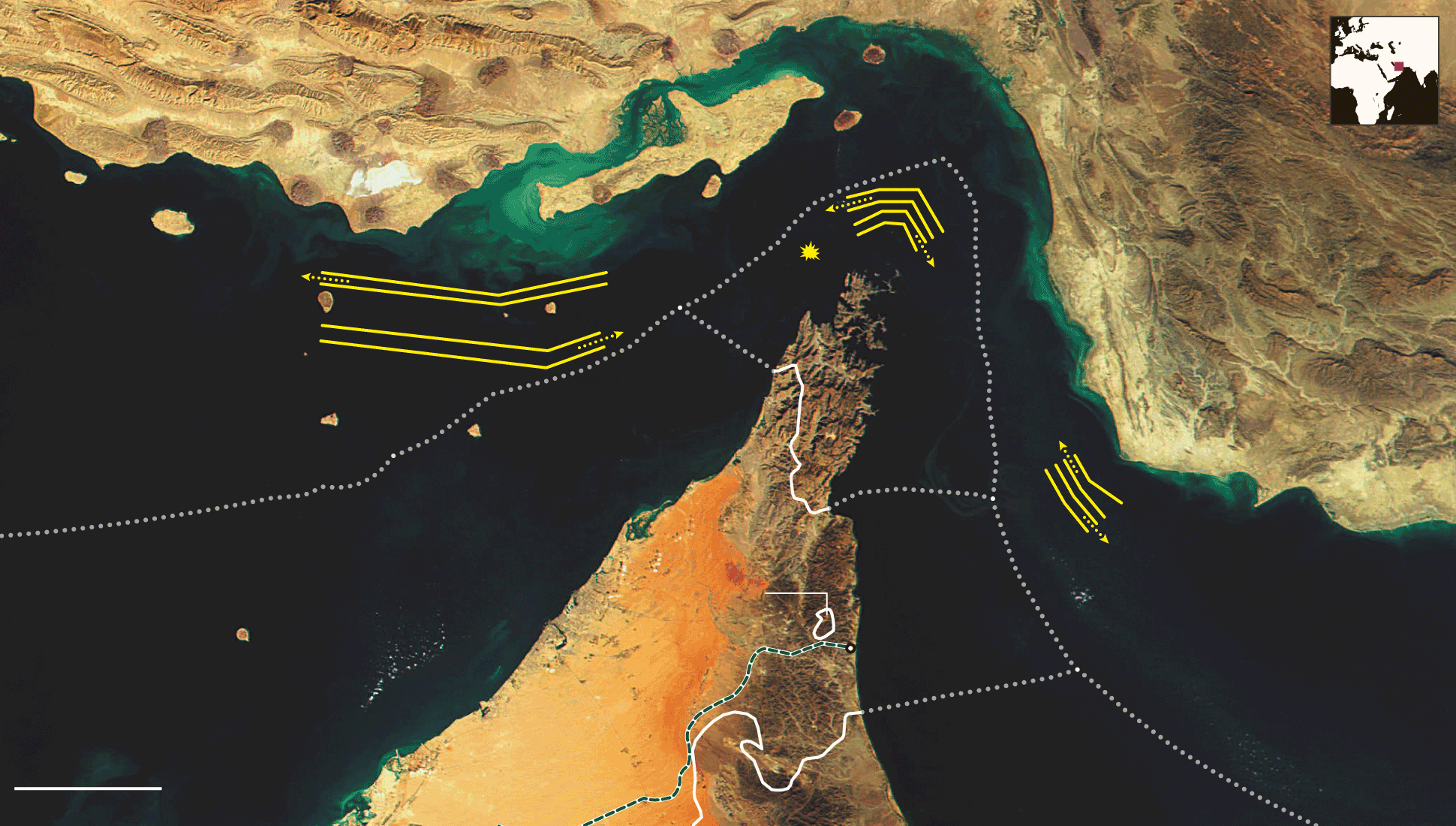

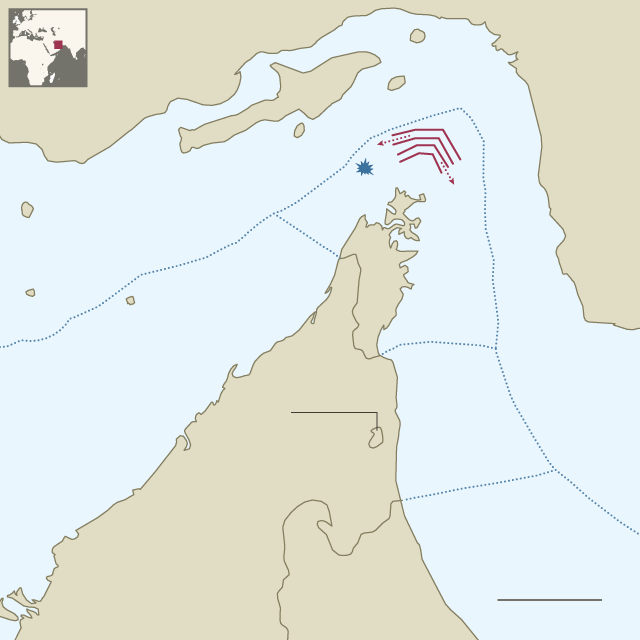

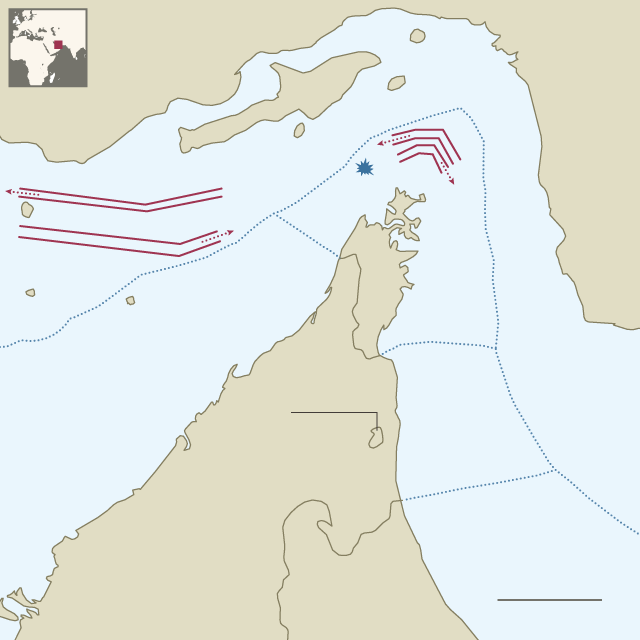

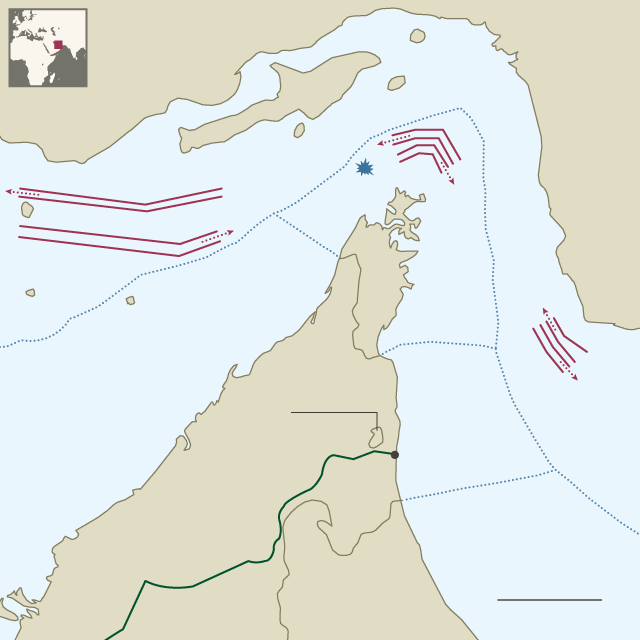

A 25-mile long separation scheme keeps inbound and outbound vessels apart in corridors just two miles wide, separated by another two-mile corridor. At its narrowest point, between Oman and Iran, the strait is less than 21 miles wide.

Outside the strait proper, in another crucial spot, ships are kept apart in the 50-mile long traffic corridor. This consists of two lanes roughly two to three miles wide, separated by a buffer area eight miles wide.

Two 2-mile wide lanes separated by a 2-mile buffer forces supertankers into Iranian territorial waters.

The 380km pipeline can transport 1.5m b/d of crude oil, allowing more than half of the UAE’s oil production to bypass the strait.

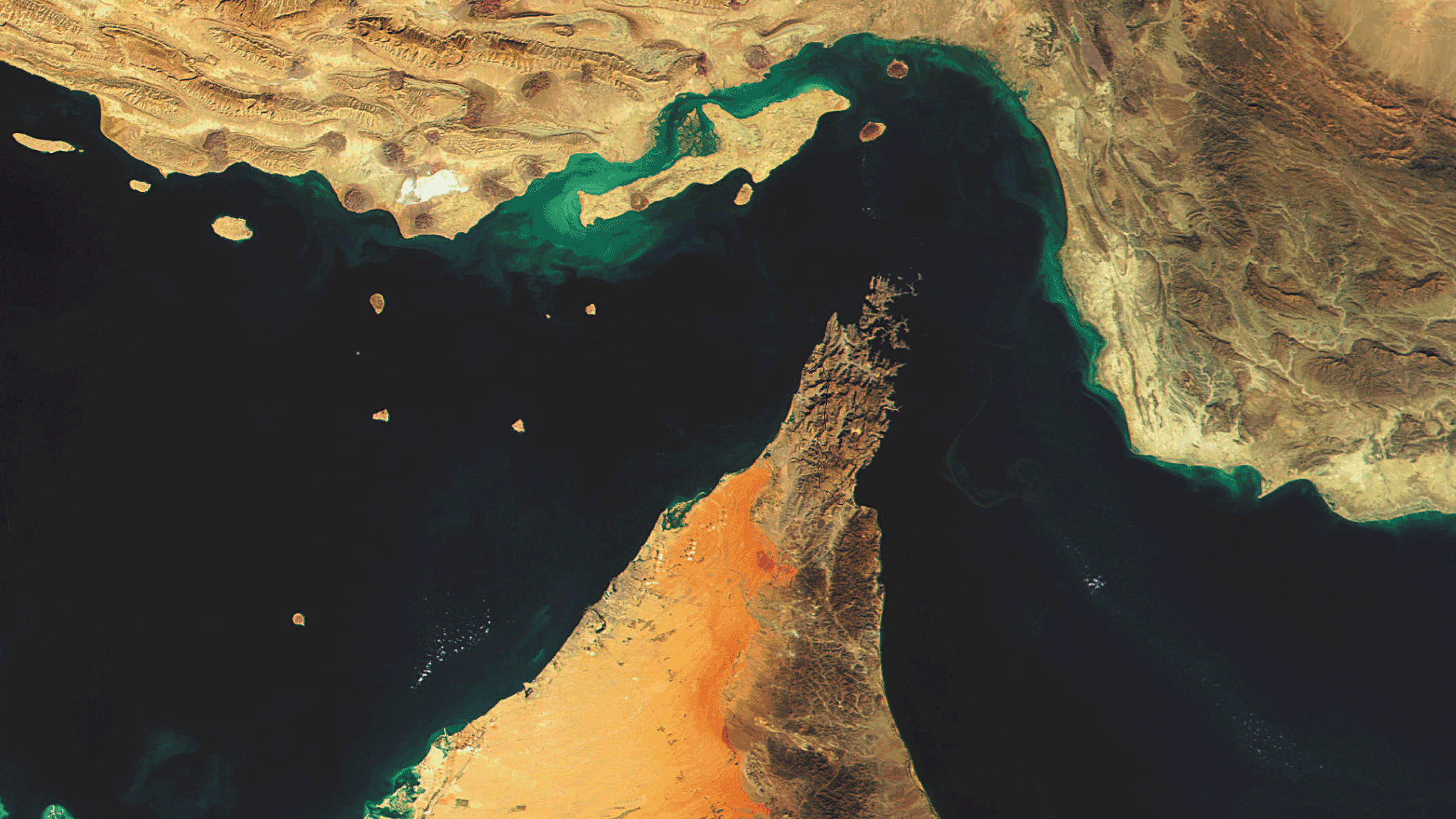

The chart showed deep water beneath the keel as the M Star supertanker steered a smooth course out of the Gulf. But minutes after midnight, at 26°27’ North, 56°14’ East, in Omani waters, the ship suddenly lurched.

The captain and some of his crew of 30 Indians and Filipinos reported a flash, quickly followed by what sounded and felt like an explosion.

The double hull, holding about 2m barrels of crude oil, withstood the explosion but damage was visible inside. The captain ordered an immediate change of course to the nearest port of Fujairah, in the United Arab Emirates. When the tanker dropped anchor, the crew found an 11-metre wide, one-metre deep dent in the starboard hull just above the waterline – scarred by the marks of a blast.

Mystery still surrounds the incident. According to Mitsui OSK Lines, owners of the vessel, there seemed to have been “an attack from external sources”. But whatever happened that night in July 2010, the explosion that hit the 330-metre tanker serves as a reminder of the risks of the Strait of Hormuz, the world’s most critical energy nexus. Some 35 per cent of all crude oil carried by ship passes through the 21 nautical mile wide choke point between Iran and Oman.

IRAN

Location of M Star tanker explosion

1

OMAN

Maritime

boundary

OMAN

UAE

OMAN

50 km

27 nautical miles

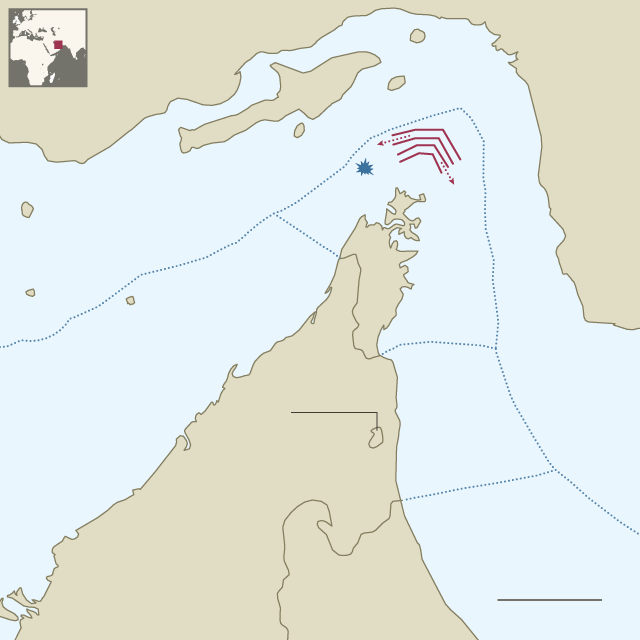

A 25-mile long separation scheme keeps inbound and outbound vessels apart in corridors just two miles wide, separated by another two-mile corridor. At its narrowest point, between Oman and Iran, the strait is less than 21 miles wide.

IRAN

Location of M Star tanker explosion

2

OMAN

Maritime

boundary

OMAN

UAE

OMAN

50 km

27 nautical miles

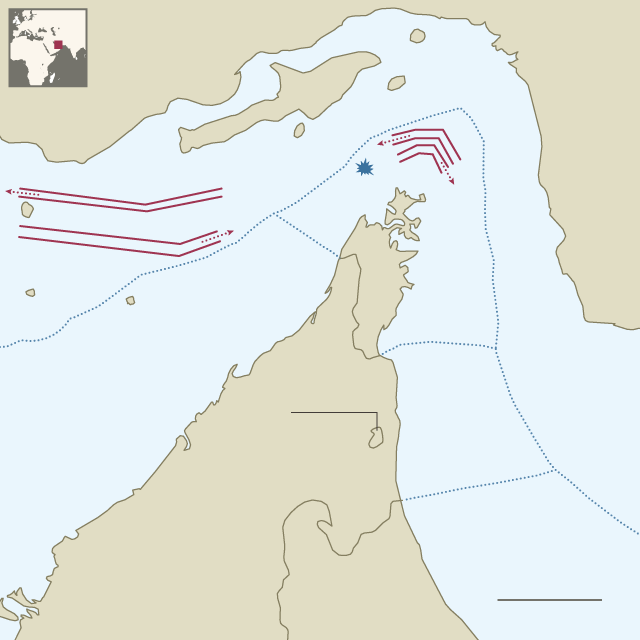

Outside the strait proper, in another crucial spot, ships are kept apart in the 50-mile long traffic corridor. This consists of two lanes roughly two to three miles wide, separated by a buffer area eight miles wide.

IRAN

Location of M Star tanker explosion

OMAN

Maritime

boundary

3

OMAN

UAE

OMAN

50 km

27 nautical miles

Two 2-mile wide lanes separated by a 2-mile buffer forces supertankers into Iranian territorial waters.

IRAN

Location of M Star tanker explosion

OMAN

Maritime

boundary

OMAN

Fujairah

UAE

4

OMAN

50 km

27 nautical miles

The 380km pipeline can transport 1.5m b/d of crude oil, allowing more than half of the UAE’s oil production to bypass the strait.

IRAN

Location of M Star tanker explosion

1

OMAN

Maritime

boundary

OMAN

UAE

OMAN

50 km

27 nautical miles

A 25-mile long separation scheme keeps inbound and outbound vessels apart in corridors just two miles wide, separated by another two-mile corridor. At its narrowest point, between Oman and Iran, the strait is less than 21 miles wide.

IRAN

Location of M Star tanker explosion

2

OMAN

Maritime

boundary

OMAN

UAE

OMAN

50 km

27 nautical miles

Outside the strait proper, in another crucial spot, ships are kept apart in the 50-mile long traffic corridor. This consists of two lanes roughly two to three miles wide, separated by a buffer area eight miles wide.

IRAN

Location of M Star tanker explosion

OMAN

Maritime

boundary

3

OMAN

UAE

OMAN

50 km

27 nautical miles

Two 2-mile wide lanes separated by a 2-mile buffer forces supertankers into Iranian territorial waters.

IRAN

Location of M Star tanker explosion

OMAN

Maritime

boundary

OMAN

Fujairah

UAE

4

OMAN

50 km

27 nautical miles

The 380km pipeline can transport 1.5m b/d of crude oil, allowing more than half of the UAE’s oil production to bypass the strait

In the M Star case, Tehran quickly distanced itself from the blast, saying it must have been accidental. Yet two years later, worries about Iran have only intensified.

Sanctions imposed over Iran’s nuclear programme have grown tighter, and the effects are being felt across the country. Fears are rising that Iran’s leadership, facing increasing domestic unrest over spiralling inflation, has less and less to lose through brinkmanship in the channel now that its own oil income is being squeezed to a trickle. For years, oil traders were inured to rhetoric from Iran that it stood poised to shock world energy markets by blocking the seaway in retaliation for sanctions or an Israeli attack. They were sceptical it would engineer a crisis in a region so critical to its own economic survival. But Iran’s plummeting oil exports mean that a cornered Tehran could see a confrontation in the strait as less an act of self-immolation and more a calculated gamble.

Given Iran’s vertiginous economic decline, governments are paying more heed to what Tehran’s threats mean to their crude supplies. Only last month, western nations conducted their biggest minesweeping drill in the Gulf, stressing the critical importance of safeguarding Hormuz.

Governments, including Saudi Arabia, have also spent billions on pipelines to bypass the strait, accelerating work over the past 18 months. In addition, they are building oil storage facilities near key markets in an effort to guarantee the supply of oil even in the event of a military clash.

Earlier this year, Riyadh and Abu Dhabi opened new pipelines that will increase the ability of countries to bypass the strait. Fully operational, 6.5m barrels per day, or about 40 per cent of total flows, will now be able to take alternative routes. “The Middle East is much better prepared now than a year ago to cushion the impact of a disruption in the Strait of Hormuz,” says Edward Morse, head of commodities research at Citigroup and former US deputy assistant secretary of state for international energy policy.

However, in spite of these new projects, the vast majority of oil trade will remain seaborne and at the mercy of the Strait of Hormuz. Kuwait, Qatar, Bahrain and Iran itself have no alternative routes through which to ship their oil.

It is hard to overstate the waterway’s role in energy markets. Cyrus Vance, former US secretary of state, once called it “the jugular vein” of the global economy.

Strangling that jugular would push oil and natural gas prices to levels that would endanger economic growth worldwide. David Goldwyn, a Washington-based consultant and, until recently, the US state department’s top diplomat for oil affairs, says the strait is at “the top of the risk list” for energy and military planners. “It is one of the single, largest vulnerabilities that we have in terms of oil supply.”

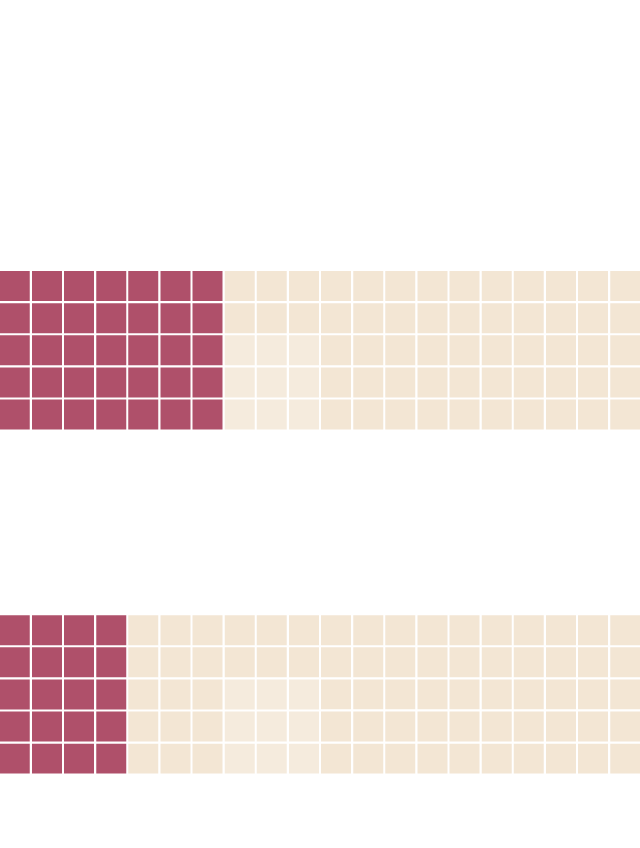

Energy markets dependent

on the Strait of Hormuz

Oil

17m

barrels per day

35%

of world’s

seaborne

traded oil

Natural gas

2tn

cubic ft per day

20%

of world’s

liquefied natural

gas trade

Sources: EIA; IEA

Energy markets dependent on the Strait of Hormuz

Natural gas

Oil

2tn

17m

cubic ft per day

barrels per day

20%

35%

of world’s liquefied

natural gas trade

of world’s

seaborne traded oil

Sources: EIA; IEA

Last year, roughly 17m b/d of oil produced in the UAE, Qatar, Bahrain, Saudi Arabia, Kuwait, Iraq and Iran passed through the channel. Moreover, about 2tn cubic feet per year of liquefied natural gas – or supercooled gas turned into a liquid so it can be shipped – sailed through the strait, equal to almost 20 per cent of global LNG trade.

Trade on such a scale hands preponderant leverage to the Iranian military. Only last month, General Mohammad Ali Jafari, head of the Revolutionary Guards, said: “If war occurs in the region and [Iran] is involved, it is natural that the Strait of Hormuz, as well as the energy [market], will face difficulties.” Last year, one admiral quipped Iran could close the strait “more easily than drinking a glass of water”.

Energy traders had long been confident that Iran’s threats were bluster, intended to discourage Israel and the US from air strikes against its atomic facilities. The strait is, after all, the gateway not only for all of Iran’s own oil exports but also for much of its food imports. There seemed little danger Iran was ready to risk conflict. But the country’s financial decline has started to worry policy makers.

Its moribund crude oil industry is a particular worry. Sanctions mean that production is declining fast, recently hitting a 22-year low. Its exports had fallen from 2.4m b/d in early 2011 to just 0.8m b/d in August. If exports were to drop much further, the incentives on Iran to shut down the strait would grow as it would not need to worry so much about its oil flow.

President Mahmoud Ahmadi-Nejad also faces increasingly volatile domestic politics with conservative politicians and businessmen intensifying a power struggle before elections next year. This week, merchants came out on strike over the plunging value of the rial.

Fearing Mr Ahmadi-Nejad could seek a diversion through international sabre-rattling, policy makers say that Iran could easily find ways to disrupt world energy supplies without a direct attack. Some argue it could board every supertanker transiting its territorial waters under other pretexts, such as inspecting for weapons smuggling. Others fear it could even use proxies to fight its war, with terrorist organisations carrying out attacks. Those actions would both slow oil flows and push up prices. Tehran would win a double victory: continuing its own remaining oil sales while benefiting from higher prices. Amrita Sen, senior oil analyst at London-based Energy Aspects, says that domestic pressure and economic collapse could force Tehran back to the negotiating table over its nuclear programme. “But, on the other hand, it also makes more likely a provocative action by Ahmadi-Nejad.”

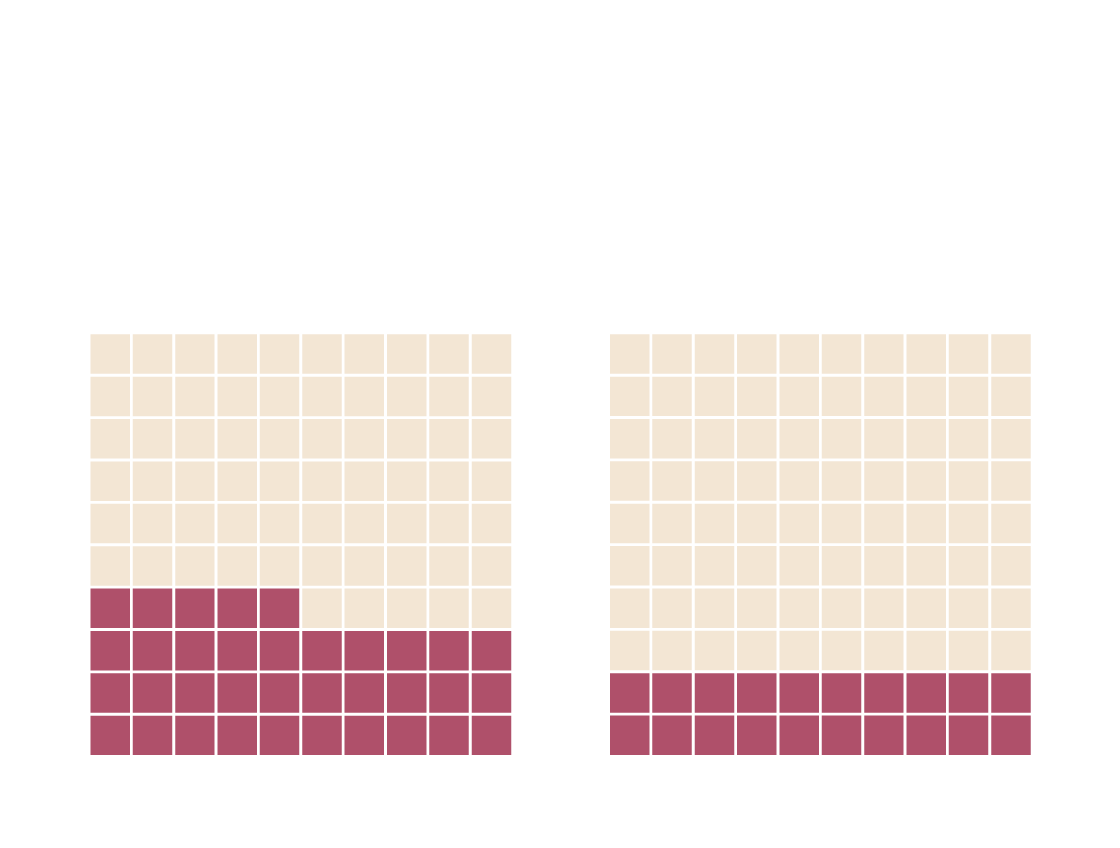

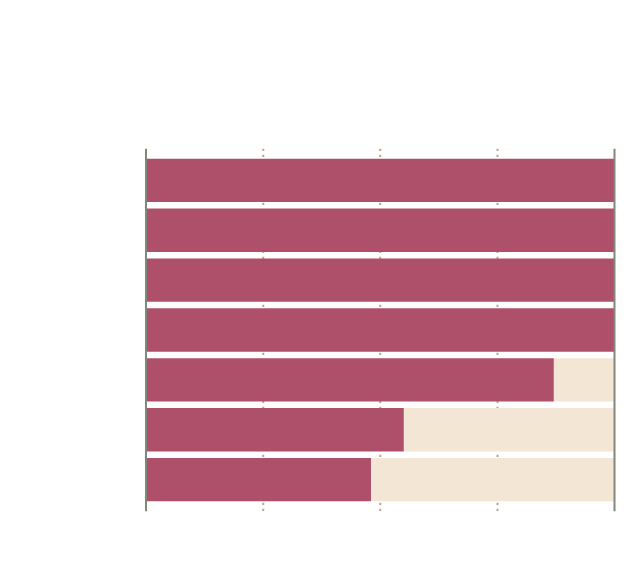

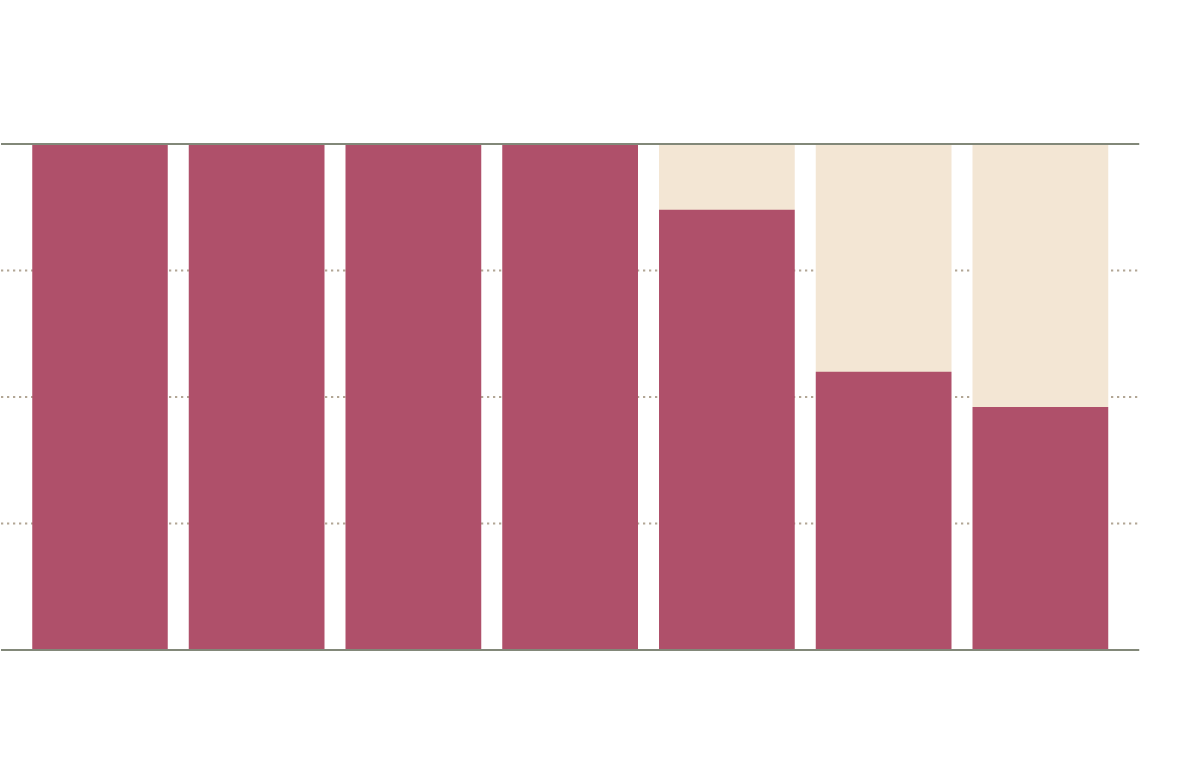

Oil producers

Crude that has to pass through the strait,

% of total exports

Iran

100

Kuwait

100

Bahrain

100

Qatar

100

Iraq

87

UAE

55

Saudi Arabia

48

Sources: EIA; IEA

Oil producers

Crude that has to pass through the strait (% of total exports)

100

50

0

Iran

Kuwait

Bahrain

Qatar

Iraq

UAE

Saudi Arabia

Sources: EIA; IEA

Seeking to counter Iran’s influence, many nations are building up their military presence in the Gulf. September’s drills involved dozens of warships from, among others, the US, the UK, Japan, France, New Zealand, the Netherlands, Italy, Australia and Canada. Lieutenant Greg Raelson, a spokesman for the US fifth fleet, which often keeps one of its aircraft carriers in the Gulf, stressed the Strait of Hormuz was critical to “fuel economies around the globe”.

It is almost impossible to calculate the cost of policing the Gulf but Sherife AbdelMessih, chief executive of Future Energy Corporation, provides a back-of-the-envelope approximation: that the US spends roughly $90bn on its Bahrain-based fifth fleet or about $15 per barrel that crosses Hormuz.

While Washington and its Nato allies provide the bulk of the naval presence in the strait, there are growing calls for Asian countries to play a greater role as they are increasingly dependent on Hormuz. Last year, only 16 per cent of the oil that the US bought crossed the strait, down from 24.5 per cent in 1990. In the meantime, the dependence of India and China on the strait has risen steadily, last year hitting 63 and 42 per cent of their total oil imports, respectively. Among developed countries, Japan is the most exposed, as a hefty 82 per cent of its imports pass through Hormuz.

Beyond improving military readiness, one of the other responses to fears over Hormuz can be seen on the desert scrub beneath the mountains on the outskirts of Fujairah.

Eight white tanks stand on a bustling construction site, each of them measuring 110 metres in diameter, or about the length of a professional football pitch. Together they can hold 8m barrels of crude, enough to supply a medium-sized European country such as Belgium for two weeks. These enormous new vessels sit at the end of a 370km pipeline linking the oilfields near Abu Dhabi with the port of Fujairah in the Indian Ocean. The $3.5bn pipeline has a capacity of 1.5m b/d, or about 55 per cent of the country’s exports.

Such attempts to find ways of bypassing the strait are far from rare. Saudi Arabia has converted a pipeline used, until now, to transport natural gas so that it can carry crude oil. The 1,200km pipeline, which could transport up to 2m b/d – or 25 per cent of the country’s oil exports – runs from the oilfields of the Eastern Province, on the Gulf coast, to a terminal near Yanbu on the Red Sea. The 48in-wide pipeline was initially built in the early 1980s during the Iran-Iraq war, when both sides attacked oil tankers in the Gulf, to transport crude as part of the so-called East West Petroline. The line was later switched to carry natural gas but Riyadh has now quietly upgraded it for crude. Industry executives say Saudi Aramco fast-tracked the project, with little concern about cost.

Running parallel to that route to the Red Sea, Saudi Arabia also has the biggest alternative link: a 56in-wide pipeline, built three decades ago as part of the Petroline system, which can carry 3m b/d of oil.

Iraq has a 970km-long pipeline linking its northern oilfields to the Turkish port of Ceyhan in the Mediterranean. The twin pipeline has a nominal capacity of 1.6m b/d, but lack of maintenance and attacks have reduced its capacity to 400,000 b/d.

In addition, several other pipelines cross the region, but some are damaged or nearly destroyed. Iraq, for example, has a 300,000 b/d pipeline linking its northern oilfields with the Syrian port of Banias in the Mediterranean. Now half a century old, it is out of operation after being hit by US bombs in 2003. Finally, Saudi Arabia has a 60-year-old line, known as the Trans-Arabian Pipeline, or Tapline, linking its main oilfields with the Mediterranean port of Sidon in Lebanon, running through Jordan and Syria. However, the 1,200km pipeline has been out of action for decades, and is even presumed destroyed.

Even if all of these pipelines were to work at full capacity and interconnect perfectly, the core security problem would not change significantly. Ships such as the M Star will still have to file through the narrow Strait of Hormuz. On average, 13 supertankers cross it every day. Every one is a potential target.

The presentation of the graphics in this story was updated on 29z§ November 2016 to allow for clearer presentation on various mobile devices.